Section 179 Tax Benefits

Section 179 Business Tax Deductions

Protect Your Bottom Line & Maximize Your Business Goals

As a business owner, you understand the importance of balancing your resources. One of the ways the team at McLarty Ford can help you accomplish this is by introducing you to Section 179 Business Tax Deductions. This program gives you a leg up on your financial reports, keeping your business balanced between maintaining the equipment you need to perform and protecting your budget.

How Section 179 Works

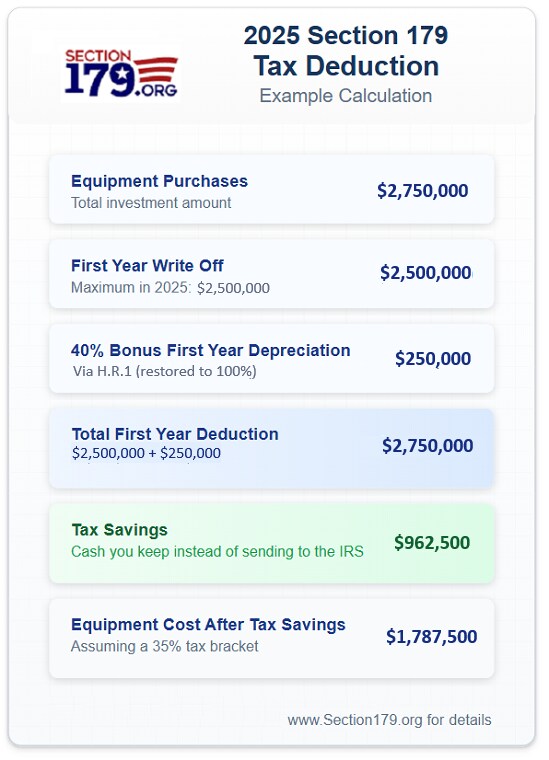

In the past, businesses were limited to writing off a portion of equipment depreciation every year. While larger organizations have different tax codes from which they can benefit, small businesses don't have the same opportunities. Section 179 changed that. Now, your business is able to write off the cost of equipment depreciation in the year it's put into service. This allows you to maximize your net income while minimizing your financial exposure.

To qualify for this program, you can purchase qualifying vehicles from McLarty Ford. We offer a great selection of automotive options that are designed to keep your business thriving. The vehicle(s) you purchase or lease will need to be used for business purposes within the United States at least 50% of the time.

Section 179 Tax Deductions for 2025

Every year can bring changes to the tax code. In 2025, there are some key points about Section 179 that we want you to know.

Deduction Limit in 2025: $1,250,000

Qualifying vehicles that have been leased or purchased between January 1, 2025, and the end of day on December 31, 2025, are impacted

Spending Cap on Equipment Purchases in 2025: $3,130,000

Once the 2025 spending cap is reached, deductions will be reduced dollar-for-dollar.

Phase-Out Threshold: $4,380,000

Deductions phase out once reaching this threshold.

Bonus Depreciation in 2025: 40%

The Bonus Depreciation occurs when the Spending Cap is reached.

What Ford Models Qualify?

Take a look at our inventory and find the right vehicle for you.

- Ford F-150®

- Ford F-150 Lightning®

- Ford Super Duty®

- Ford Transit®

- Ford Explorer®

- Ford Expedition®

Contact McLarty Ford to Learn More

Our team is excited to support you. Contact us online or call our dealership to learn more about Section 179 Business Tax Deductions.

How can we help?

* Indicates a required field

-

McLarty Ford Texarkana

3232 Summerhill Road

Texarkana, TX 75503

- Sales: (903) 792-7121